Money VS. Happiness: It's Complicated

The age-old question of whether money can buy happiness has fascinated thinkers across disciplines for centuries. While the adage suggests that it cannot, research paints a more nuanced picture – one where income and happiness are undoubtedly linked, but in complex and often surprising ways. This expanded essay delves into the historical context of this question, examines how income levels, tax brackets, spending habits, financial security, and income inequality shape individual and societal well-being, and explores the policy implications of these insights.

A Historical Lens on Happiness Happiness has been a subject of philosophical inquiry since ancient times. Aristotle, one of the earliest thinkers to systematically examine the concept, argued in his Nicomachean Ethics that happiness (eudaimonia) is the highest good and the end goal of human existence. For Aristotle, happiness was not a fleeting emotional state but a life well-lived, achieved through the cultivation of virtue and the fulfillment of one's potential.

Fast forward to the 20th century, and psychologists began to empirically study happiness and its determinants. One influential theory that emerged was Abraham Maslow's hierarchy of needs (1943). Maslow proposed that human needs can be organized into a hierarchy, with basic physiological needs (food, water, shelter) at the bottom, followed by safety needs, love and belonging, esteem, and finally, self-actualization at the top. This theory suggests that individuals must first fulfill lower-level needs before they can pursue higher-level ones. In this framework, income is crucial for meeting basic needs and laying the foundation for further growth and self-realization.

The Easterlin Paradox, named after economist Richard Easterlin, added another layer of complexity to the income-happiness relationship. In his seminal 1974 paper, Easterlin found that within countries, wealthier individuals were generally happier than poorer ones, but when comparing countries, average happiness levels did not increase in line with rising GDP per capita over time. This finding challenged the assumption that economic growth alone could lead to greater well-being and spurred further research into the nuances of this relationship.

Income Levels and Diminishing Returns Numerous studies have confirmed that higher income is associated with greater life satisfaction and happiness, but with an important caveat – this relationship is not linear. The "diminishing returns" phenomenon suggests that beyond a certain income threshold, additional money has a smaller impact on happiness.

A landmark study by Princeton University researchers Daniel Kahneman and Angus Deaton (2010) found that in the United States, emotional well-being (the frequency and intensity of positive and negative experiences) plateaus around an annual income of $75,000. Beyond this point, additional income did not significantly improve day-to-day happiness, although it continued to enhance overall life evaluation.

It's important to note that this threshold is not universal and varies across countries and regions. Factors such as cost of living, cultural values, and social safety nets can influence where the satiation point lies. In countries with strong welfare systems, such as Denmark and Sweden, the threshold may be lower because basic needs are more easily met through public services. Conversely, in cities with high living costs, like New York or San Francisco, the threshold may be higher.

Moreover, the relationship between income and happiness is bidirectional. While higher income can lead to greater happiness, happier individuals are also more likely to be successful and earn higher incomes. Positive emotions have been linked to better health, stronger social connections, and improved job performance, all of which can contribute to financial success.

The Psychology of Tax Brackets The design of tax systems, particularly the structure of tax brackets, can significantly influence perceptions of fairness and overall happiness. Most countries, including the United States, have progressive tax systems where higher earners pay a larger share of their income in taxes. In the U.S., there are seven federal income tax brackets for the 2023 tax year, ranging from 10% for the lowest earners to 37% for the highest.

Progressive taxation is intended to redistribute wealth and reduce income inequality. The underlying principle is that those with greater means should contribute more to public goods and services. However, the psychological effects of taxation are not always straightforward.

High tax rates can breed resentment and decrease motivation, especially if individuals perceive the system as unfair or if they feel they are not getting adequate value for their contributions. On the flip side, knowing that one's taxes are funding important public services and helping to reduce inequality can enhance feelings of social responsibility and connectedness.

Cross-cultural comparisons offer valuable insights into the relationship between taxation and happiness. Scandinavian countries, for instance, are known for their high tax rates but also rank consistently high on happiness indices. This apparent paradox can be explained by the fact that these countries provide extensive public services, such as universal healthcare, education, and generous social safety nets, which contribute to overall well-being. In these contexts, the perceived benefits of tax-funded services seem to outweigh the psychological costs of paying high taxes.

The Art and Science of Happy Spending How people spend their money is just as important as how much they earn when it comes to happiness. Research in the field of "happiness economics" has identified several principles for maximizing the happiness bang for your buck.

One key insight is that experiences tend to provide more lasting happiness than material possessions. A study by Van Boven and Gilovich (2003) found that people derived greater satisfaction from experiential purchases (e.g., vacations, concerts, meals out) than material ones (e.g., clothes, gadgets, jewelry). Experiences are more likely to be shared with others, linked to one's sense of self, and less prone to hedonic adaptation (the tendency to quickly adjust to new circumstances).

Spending money on others, known as prosocial spending, is another research-backed path to happiness. A series of studies by Dunn, Aknin, and Norton (2008) found that spending money on others, whether through gifts or charitable donations, consistently led to greater happiness than spending on oneself. This held true across a range of amounts and cultural contexts. Prosocial spending fosters social connection and a sense of meaning, both key ingredients for a satisfied life.

The role of financial literacy in happy spending cannot be overstated. Individuals who understand budgeting, saving, investing, and debt management are better equipped to make sound financial decisions that promote long-term well-being. They are more likely to live within their means, save for the future, and avoid the stress and anxiety that come with financial troubles.

Building a Foundation for Long-Term Happiness Financial security is a critical component of long-term happiness and peace of mind. Living paycheck to paycheck or being one emergency away from financial ruin can take a heavy psychological toll. On the flip side, having a financial safety net and a plan for the future can greatly reduce stress and allow individuals to focus on other areas of life.

A common rule of thumb is to have an emergency fund covering three to six months of living expenses. This buffer can help weather unexpected setbacks, such as job loss, medical emergencies, or car repairs, without derailing one's longer-term financial plans.

Retirement planning is another key aspect of financial security. With increasing life expectancies and the decline of traditional pension plans, the onus is increasingly on individuals to save for their own retirement. Experts recommend saving at least 10-15% of one's income in tax-advantaged retirement accounts, such as 401(k)s or IRAs, starting as early as possible to take advantage of compound growth.

Diversification is a central tenet of smart investing and risk management. By spreading investments across different asset classes (e.g., stocks, bonds, real estate) and geographies, investors can mitigate the impact of market volatility and economic downturns on their portfolios.

However, financial security is not just about numbers. It also involves a sense of control and confidence in one's ability to handle financial challenges. Financial education and empowerment can help individuals feel more in charge of their financial lives and better equipped to make informed decisions.

The Societal Cost of Inequality Income inequality has risen to the forefront of public discourse in recent years, and for good reason. High levels of inequality can have corrosive effects on social cohesion, trust, and overall happiness.

Research consistently shows that more equal societies tend to be happier ones. The World Happiness Report, an annual publication of the United Nations Sustainable Development Solutions Network, has found a strong negative correlation between income inequality (as measured by the Gini coefficient) and average national happiness scores.

There are several potential explanations for this relationship. Inequality can breed feelings of relative deprivation and status anxiety, as people compare their own standard of living to that of the super-rich. It can also erode social capital and trust, as people perceive society as unfair and rigged in favor of the wealthy.

Inequality of opportunity is particularly damaging to societal well-being. When people feel that the deck is st

Creators & Guests

Podcast Reviews

Mentioned In These Lists

Host or manage this podcast?

Claim and edit this page to your liking.

Use this to check the RSS feed immediately.

Podcast Details

Podcast Tags

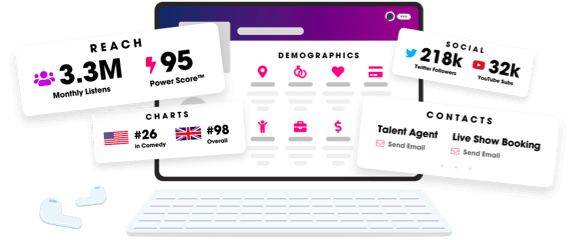

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us